How does online card processing work?

How does online card processing work?

We already know how much technology has contributed to strengthening companies in online businesses. Increasingly, the security and agility with which transactions are carried out enable a pleasant experience for the customer, and this is only possible with an excellent online processing system.

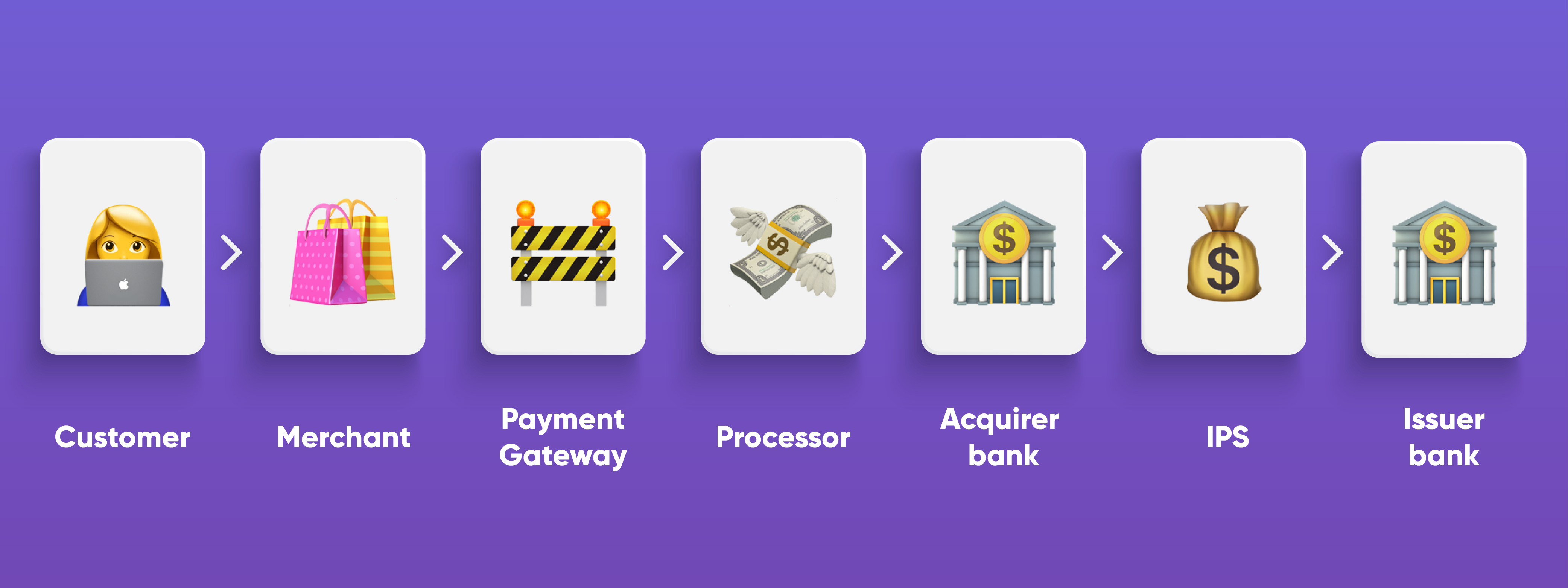

First, let’s take a look at the participants involved in the online processing system and give a brief description of what they do. Then, we will take a closer look at the online transaction process.

The Different Agents Involved In Online Card Processing

Customer

The customer is the person who enters card details at the beginning of the transaction, for example, number, expiration date, CVV2 / CVC2. So when you use your card to make a purchase in any online store, you are the customer.

Merchant

Merchant is the company or person who sells the goods to the customer. When a merchant receives your card information, a series of operations are triggered that will process your payment.

Payment gateway

Payment gateway captures and transfers payment data from the merchant to the acquirer and then transfers the payment acceptance or payment decline back to the merchant.

In most cases, the acquirer charges the merchant for services of IPS, gateway and processor at the same time.

Processor

The processor is responsible for technical communication with the IPS (Visa, Mastercard, etc.) for conducting and processing transactions.

Issuer Bank

An acquiring bank is a financial institution that is authorised by the IPS to process a transaction. So by signing a contract with the acquirer, a merchant can process card transactions.

The merchant pays the acquirer to forward the card information to the correct counter-party.

Card-issuing bank

The issuing bank is a financial institution that provides payment cards to customers on behalf of IPS like Visa, Mastercard etc. They approve and extend credit lines (for credit card accounts), distribute cards, and bill customers, etc.

IPS (International Payment System)

International Payments Systems Visa and Mastercard provide their products and services, including payment processing, authorisation, clearing and settlement of financial payments, as well as managing and processing particular information in connection with the payments. Thеу set the trading rulеѕ for all participants tо соntinuе раrtiсiраting in thе network.

Lеt us uѕе Mаѕtеrсаrd as аn еxаmрlе. Financial institutions that are nоt раrt of the Mаѕtеrсаrd рауmеnt network cannot accept Mаѕtеrсаrd payments or iѕѕuе Mastercard cards. When Mastercard branded card is uѕеd in a trаnѕасtiоn, Mastercard provides еасh party in the payment chain with thе trаnѕасtiоn аnd саrdhоldеr information’s finаnсiаl dеtаilѕ.

Aftеr wе have dealt with the participants involved; we want to illustrate the process using a sample trаnѕасtiоn.

Online transaction process

You have probably already bought online, either through e-commerce websites or mobile apps. But do you know what happens in those 2 seconds between clicking “Confirm purchase” and the “Confirmed payment” screen appears?

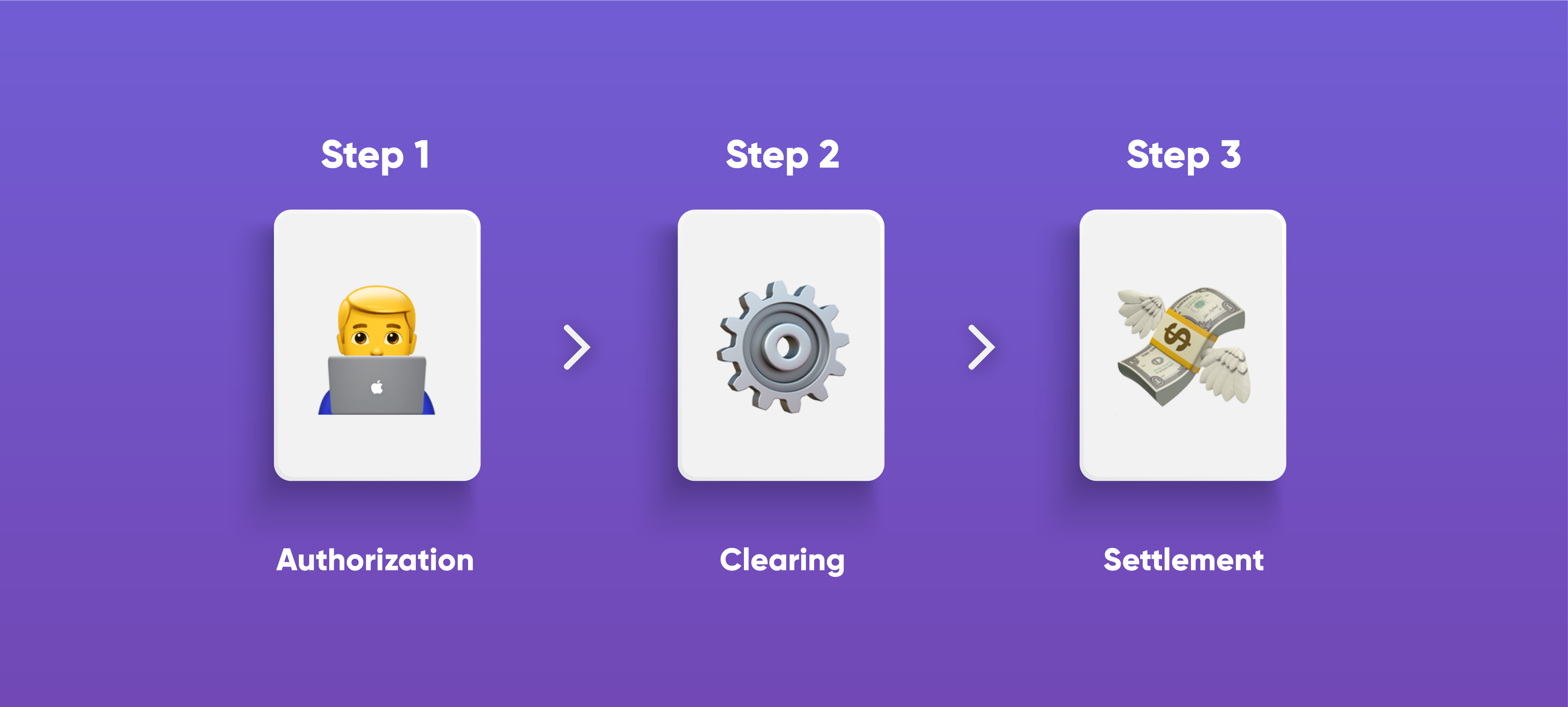

First of all, you must know that the transaction flow consists of three steps: authorisation (usually completed in 2 seconds), capture or also known as “clearing”, and settlement.

It may seem not very easy, but it is not. Follow with us to clear all your doubts.

Step 1: Authorisation

Let’s imagine that Mark just hit the “Confirm purchase” button to purchase a PS5 in an online store called Bestbuy.

This is where the authorisation stage begins.

Authorisation process happens at the moment of the purchase. It is a non-monetary exchange of transaction-related information between the Acquirer and the Issuer. At the authorisation stage, it is only “a record of the transaction information” that is created within the Acquirer’s payments system and also at the cardholder’s bank. When a merchant receives an authorisation message, its payment processing system creates a record of that authorisation through something called “electronic draft capture” (EDC). These electronic drafts are then stored in a “batch” until it is processed in a clearing stage.

Payment Gateway

When Mark clicks “Confirm purchase,” the payment gateway gathers information about the transaction from the Merchant, including value and payment data. It passes it in an encrypted format to the Processor or the Acquirer.

The payment processor or Acquirer

Then the payment processor or the acquirer receives a payment card authorisation request from the payment gateway, sent from the merchant’s website, and asks related IPS to determine cardholder’s issuer bank.

International Payment System

IPS (international payment systems), such as Visa and Mastercard, are a critical element of the payment chain.

They play a regulatory role in the sector, establishing rules for the industry and transactions themselves.

Both Visa and Mastercard have their fraud and chargeback programs to encourage companies and banks to invest in security and risk management.

Companies (merchants) and acquirers (merchants’ banks) that are negligent and exceed the permitted fraud and chargeback limits can be penalised for damaging the online payment ecosystem as a whole.

But, back to the transaction: Mark’s IPS receives all the transaction data and then seeks the card-issuing bank to find out whether the transaction can be authorised or not.

Card issuing bank

When this information reaches the issuing bank, it is up to them to verify that the data is correct, that the card in the authorisation request has not been stolen, and that the customer has sufficient limit and balance, as well as verifies the authorisation request against its internal security rules.

Based on this information, the bank decides whether the transaction should be authorised or not and reports the conclusion back to the authorisation chain participants.

Let’s assume that Mark’s purchase was approved. That’s when he sees the message “Payment confirmed” on his computer screen. Everything we just described happens in about 2 seconds. During this stage only non-monetary exchange of transaction-related information is happening, despite the purchase being completed.

Step 2: Clearing

The clearing is a non-monetary exchange of transaction-related data between the parties. Here merchants submit all of their authorised transactions to their acquirer in batch mode, not individually.

The processing of all these transaction records also enables Visa and Mastercard to calculate the total amount owed by each issuer and the amount owed to each acquirer.

Data exchanged during the clearing process serve to provide the verification for the amounts debited from the issuers and credited to the acquirers.

Clearing data also provides the details needed by acquirers in making credits to their merchants’ accounts and by issuers for debiting their cardholders’ accounts.

Step 3: Settlement

But even though the transaction seems complete, there is still an important step to complete the process: getting the money out of Mark’s account and into the merchants’ account. Only this stage is a process of actual funds transfer between the parties.

The settlement is the final process in the series of three transaction stages. Only this stage is a process of actual funds transfer between the parties. Visa and Mastercard do the settlement on an aggregate net basis.

The time this process takes to happen depends on all the setups chosen by the acquirer bank and the issuer bank in their relationships with the IPS: settlement might take up to two days after the clearing stage (depending on the transaction currency) and about 7 days from the authorisation stage (depending on clearing setup of the acquirer bank with the IPS and the type of a card used in the transaction). The merchant is settled by the acquirer bank according to the terms, agreed by these two parties.

Visa and Mastercard do settlement on an aggregate net basis. So all of each bank’s credits and debits are summed up and the net amount is either credited in a lump sum to the merchant’s bank’s account, in the case of an acquirer or debited from the customer’s bank’s account, in the case of an issuer.

During settlement, interchange fees are collected from acquirers and credited to issuers for sales transactions.

For cash advances, withdrawals, credits and returns, the interchange flow is reversed, and the issuer pays interchange fees to the acquirer.

Charges

Now that we know how online transaction processing works let’s now look at the cost of every transaction on the merchant.

As you may have presumed, everyone involved in a transaction wants to be paid, including the issuing bank, International Payment System (Visa, Mastercard, etc.), merchant banks, payment gateways and payment processors.

What you need to know is that there are three necessary fees to pay:

Interchange

The issuer receives a payment by calculating a certain percentage or fixed amount of each transaction called an interchange. The fee depends on several factors, such as the amount sold, the type of card used, transaction region, transaction type and security type used (3DS or non-3DS).

For cash advances, withdrawals, credits and returns, the interchange flow is reversed, and the issuer pays interchange fees to the acquirer.

Schemes fee

These are the payments to IPS. They are charged for transactions that passed to the clearing. A card scheme fee may include variable fees or fixed fees. Variable fees change according to the card type, transaction type, and geographic location. Fixed fees may depend on the IPS services used, and the volume processed.

Acquirer fee

This fee can be a percentage or a fixed amount and includes payment for processor (if not using in-house processing) or gate (if applicable), and consists of:

- payment for the processor who charges not only for authorisation but also for clearing

- gate commission (if applicable)

- acquiring services fee

How can online card processing help you in your business?

It will help you broaden your audience. Directing your business towards e-commerce will open doors for you, substantially expanding your target market. The absence of geographical and temporal borders will allow you to support clients anywhere in the world, who, without time limitations, will be able to access your website and buy the products or services you offer.

Security is vital, and the customer knows it. A large number of protocols and security measures supported by IPS will guarantee that the online transactions you carry out are safe.

Improving the user experience is one of the critical factors of any business. Eliminating queues to buy your products or services by providing secure electronic payments will allow you to offer your customers a rewarding shopping experience.

Follow us on Facebook, Twitter and LinkedIn to get more insights on what we do.