Corebanking

solution

Payment gateway integration

Payment processing, financial messaging and queue control implemented in 6 comprehensive steps:

- Gateway development

- Integration of gateway with banking partners

- System analysis for integration with banking partner

- Architecture design

- Development works

- Infrastructure support

Private and Pooled Accounts are generated by the platform.

Based on the open account, there are different incoming channels for making payments.

IBAN serves as a primary channel.

Email, phone, company name and card number are possible upcoming channels used for payment creation.

The functionality provides transaction mapping to financial chart of the account (CoA).

The CoA has 6-7 hierarchy levels and balance is calculated on the fly.

The engine matches original transaction to financial accounting.

The engine ensures:

- DR and CR account mapping;

- double entry principle;

- accounting equation principle

The funcionality covers tariff plan applied per specific customer account.

The contract contains tariff plan for combination of:

- payment type: incoming/outcoming

- payment method: SEPA/TARGET2/SWIFT/xpate2xpate

- rate type: fixed/min/max

Transaction log keeps all historical info about the moves.

Upon each move the balance in recalculated.

Essential part of the log engine is input generation for balance creation.

The functionality includes space for user to access customer data.

It contains main info about the customer:

- for individuals

- for businesses

Clearing provides routing logic inside the corebanking to allocate amounts to correct accounts.

Private and Pooled Accounts are generated by the platform.

Based on the open account, there are different incoming channels for making payments.

IBAN serves as a primary channel.

Email, phone, company name and card number are possible upcoming channels used for payment creation.

The functionality provides transaction mapping to financial chart of the account (CoA).

The CoA has 6-7 hierarchy levels and balance is calculated on the fly.

The engine matches original transaction to financial accounting.

The engine ensures:

- DR and CR account mapping;

- double entry principle;

- accounting equation principle

The funcionality covers tariff plan applied per specific customer account.

The contract contains tariff plan for combination of:

- payment type: incoming/outcoming

- payment method: SEPA/TARGET2/SWIFT/xpate2xpate

- rate type: fixed/min/max

Transaction log keeps all historical info about the moves.

Upon each move the balance in recalculated.

Essential part of the log engine is input generation for balance creation.

The functionality includes space for user to access customer data.

It contains main info about the customer:

- for individuals

- for businesses

Clearing provides routing logic inside the corebanking to allocate amounts to correct accounts.

Private and Pooled Accounts are generated by the platform.

Based on the open account, there are different incoming channels for making payments.

IBAN serves as a primary channel.

Email, phone, company name and card number are possible upcoming channels used for payment creation.

The functionality provides transaction mapping to financial chart of the account (CoA).

The CoA has 6-7 hierarchy levels and balance is calculated on the fly.

The engine matches original transaction to financial accounting.

The engine ensures:

- DR and CR account mapping;

- double entry principle;

- accounting equation principle

The funcionality covers tariff plan applied per specific customer account.

The contract contains tariff plan for combination of:

- payment type: incoming/outcoming

- payment method: SEPA/TARGET2/SWIFT/xpate2xpate

- rate type: fixed/min/max

Transaction log keeps all historical info about the moves.

Upon each move the balance in recalculated.

Essential part of the log engine is input generation for balance creation.

The functionality includes space for user to access customer data.

It contains main info about the customer:

- for individuals

- for businesses

Clearing provides routing logic inside the corebanking to allocate amounts to correct accounts.

Onboarding process is applicable for both individuals and businesses.

Individual must pass KYC procedure. Business must upload necessary documents.

Prior to execution, every transaction passes several steps to ensure it meets external and internal requirements. Upon completion of every step it isgrantep a specific status.

Access is divided into several parts:

- Initial access

- Access to specific roles

- Access to specific permissions.

Available to all invited users.

For users that have opened account and added a business space.

The system provides space for customer data storage starting from the basic and legal information and ending up with specific documents.

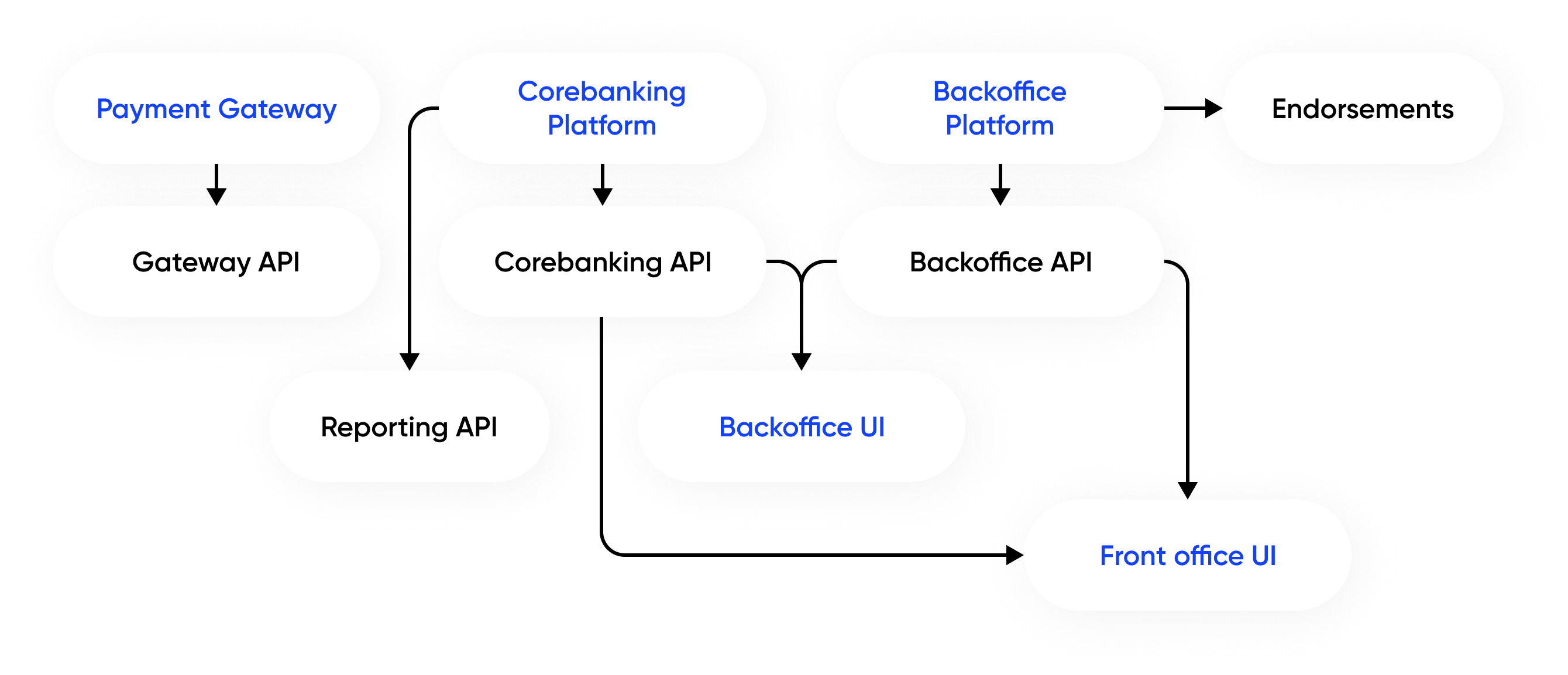

Software services diagram

We offer a highly user-oriented user interface customer facing solution.