The state of e-commerce in Argentina

Argentina is probably one of the most attractive places for investment in e-commerce. According to Statista, 70% of its population used a smartphone in 2019, and this figure will increase to 75% in 2025. Fintech has also been on a steep rise. In 2018, the sector saw a growth of 80% in just 18 months. With the number of internet users reaching a new high, mobile adoption skyrocketing, and the access to financial services becoming easier for the locals, it is evident that Argentina is one of the countries to look out for.

Thus, e-commerce veterans are hurrying up to catch the breeze. All in all, Argentina might be a new land of opportunity, and its market seems to be worth the global expansion hike.

However, the 2018 financial crisis deeply affected its business ecosystem and led to a high inflation rate, diminishing the purchasing power parity. Despite this, e-commerce grew by 64% that year and continues to do so.

While being the third-largest economy in Latin America ( with Brazil first and Mexico second), Argentina still managed to outpace the leaders in e-commerce growth rates.

Overview

Covid-19 pandemic and lockdowns worldwide made e-commerce one of the hottest topics for business in many countries, and Argentina didn’t stay aside. With a population of 44.5 million people and 37 million internet users, it’s no surprise that digital trade is taking over the country by storm. For the past two decades, the e-commerce industry in Argentina has been on a very steep rise — it grew over ten times in peso terms.

The rapid internet expansion that the country is currently experiencing led to a spike in the number of WiFi hotspots both in public and privately-owned places. Such a rapid digitalisation couldn’t go unnoticed. The Argentine Chamber of Electronic Commerce (CACE) stated that 9 out of 10 adults in Argentina have at least once made a purchase online. That’s around 18.3 million people total, and the figures keep growing.

Furthermore, the U.S. International Trade Administration reported that e-commerce in Argentina grew by 64% in 2018 and 76% in 2019. According to CACE, this year’s data portrays even more impressive results — the figures were up 106% in mid-2020 compared to the previous year.

E-commerce overview

Marketplaces

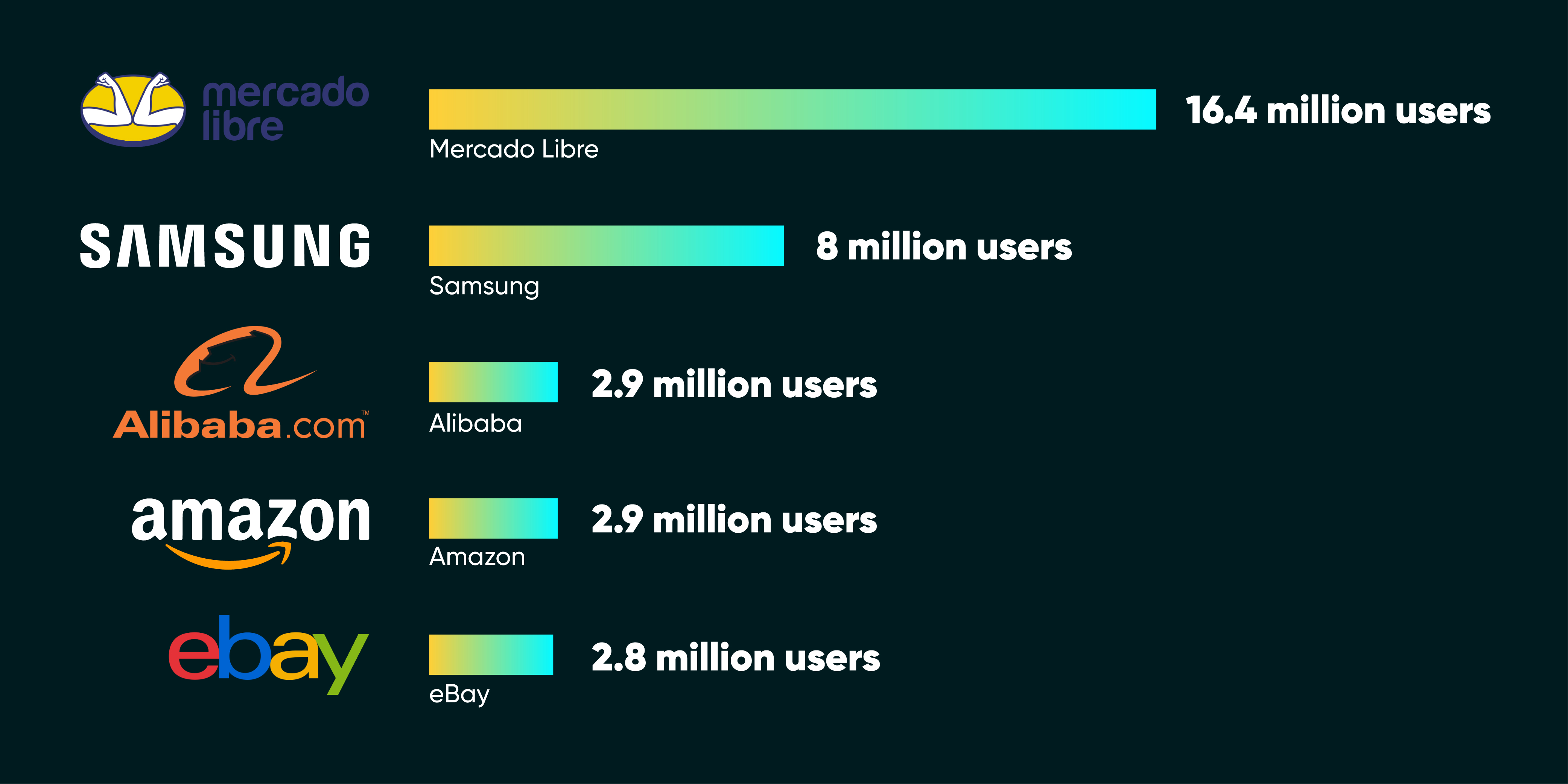

Several popular e-commerce platforms are already present on the market. Alibaba and eBay are quite popular, as well as Amazon. Surprisingly, Samsung joined the list as the second most popular e-commerce site.

Amazon has a very limited presence — the marketplace hasn’t started a full-fledged campaign in Latin America and entered Brazil relatively recently. When Argentinians shop at Amazon, they use its national or international sites. However, high shipping costs are a barrier to widespread adoption. In these circumstances, the preference is usually given to platforms available locally. Despite good opportunities, Amazon’s plans for the LatAm region are still unknown.

Nevertheless, no marketplace can compare to Argentina’s e-commerce behemoth MercadoLibre. This giant has conquered a massive chunk of the market’s share and is so popular it outweighed its close competitors by far. According to Statista, in 2019, the marketplace reported a $2.3 billion net revenue, out of which $456 million came from Argentina.

Other players include Fravega, Garbarino.com and Cencosud. Despite their current market shares being reasonably modest, they have 4.4 million users on aggregate and definitely can gain more acknowledgement in the future.

Consumer behaviour

Country’s geography shapes consumer habits. Over half of online shoppers reside in the Autonomous City of Buenos Aires (CABA), other 25% come from Argentina’s Central Region.

The overwhelming majority use mobile phones for internet access. Yet, only 30% of Argentinians prefer making orders online with their pocket device, other 70% favour laptops and desktops, according to Americas Market Intelligence (AMI).

Smartphones play a role of a research tool. The 2019 CACE survey found that 57% of e-shoppers turned to a mobile device to look for an item online.

Social media use is widespread, and businesses utilise it accordingly. In 2018, Eos Intelligence reported that 73% of all customer communication went through social media platforms, mainly Facebook and Youtube.

According to a Societe Generale report, $350 is the yearly average that a person in Argentina spends on e-commerce purchases. This figure is projected to grow and reach $500 by 2021.

International purchasing habits

If Argentinians can’t find something locally, they go global. According to the PayPal report, 43% of the country’s e-shoppers made international purchases in 2018. 23%, 16% and 6% of goods came from the United States, China and Chile respectively.

Most popular online payments in Argentina

Argentina has the second-highest GDP per capita among Latin American countries and a well-developed middle class. However, long years of instability and uncertainty changed the economy and paved a way to an informal, cash society. As a result, local payment methods prevail, even in e-commerce.

Cash

Cash payments play an important role in Argentina’s e-commerce industry. Offline services like PagoFacil, Cobro Express and RapiPago all offer cash transfers. Similar to Western Union, they have many points around the country. After ordering online, a service generates a coupon that must be paid offline. After that, all a person needs to do is come to a specific location and pay for the goods.

Cash payment method is popular with the unbanked segment of Argentina’s society, one of the country’s problems. According to S&P Global, the number of people without a bank account vary between 20% and 52%. However, a relatively young fintech industry aims to solve this issue — e.g. MercadoLibre is leading an e-payment movement and promoting virtual e-wallets and prepaid cards.

E-payment methods

According to 2020 AMI research, the most favoured online payment method is a credit card, both domestically and internationally. It accounts for 46% of all online purchases. Wallets come second with 26%, debit cards and voucher payments share third place with the combined 22%. Bank transfer is the least preferred method, although 3% consider it to be the best option. Instalment is a very popular payment method among households. According to AMI, 77% tend to pick it as a preferred option.

Alternative payment methods

Alternative, well-known payment methods such as PayPal or Stripe are not very widespread and can’t compete with local options. They don’t specialise in the emerging markets and provide a one-size-fits-all solution: payments that those financial services accept have to be done through an international credit card. However, in Argentina, banks offer two options, either a local or international credit card, where the former only works for local transfers. While the local credit card is common, international credit cards are owned by 19% of the population, making the market unattractive for the well-known online payment giants. Cash is still king, and PagoFacil, Cobro Express, and RapiPago hold their positions firmly.

Obstacles

Despite the growing popularity and impressive results in the past two decades, e-commerce is suffering from multiple issues that must be resolved to accelerate digital trade adoption.

Shipping

At the moment, Argentina’s logistics infrastructure is a weak spot and a burden for online shoppers. Due to its unsatisfying state, shipping costs might exceed the value of an item. Customers have to double pay for the bumpy roads or wait for weeks for their purchase to arrive. Aggregated Logistics Performance Index gave Argentina the 62nd place, way below the developed countries.

Lack of trust

In 2019, 21% of CACE survey respondents stated they do not trust e-commerce due to the shady websites’ presence. However, online retail slowly but surely is conquering the hearts of even the most suspicious — in 2016, the distrust was higher, at 30%.

Credit Card Limitations

According to Eos Intelligence, 50% of all issued Visa and MasterCard credit cards in Argentina cannot be used for international transfers. That is a significant limitation of people’s global purchasing ability.

Fraud

Due to the Covid-19 measures, 83% of Argentinians leave their home out of a necessity. Such daily life changes led to a spike of online fraud — phishing, malware and ransomware attacks, impersonation. That is particularly true for Argentina, where 6.3% of digital purchases do not go through due to fraud-related suspicions.

At the same time, e-shoppers demand online merchants to make the checkout process safer and easier. The main issue is that the two cannot go hand-in-hand together. MasterCard found that complexity makes 28% of customers leave without finishing the process, despite 60% claiming that the enhanced security will motivate them to buy online more in the other survey. While the balance is yet to be reached, Argentina needs to find it in the nearest future.

“PAIS” tax

In December 2019, the government of Argentina introduced “PAIS” tax. The regulation imposes 30% tax on goods bought outside of the country’s jurisdiction or with a foreign currency. Tourism and online services (e.g. Amazon Prime) also fall under taxation. An additional 35% withholding income tax, introduced in 2020, covers international card transfers and USD dollars purchase.

All that combined limits the ability to shop online and introduces barriers to further e-commerce adoption.

Conclusion

There was never a better time to turn to e-commerce. With lockdowns and instability, digital trade has become a safe oasis for shoppers all around the world. Moreover, it is continuously developing and improving, especially in Latin America and particularly in Argentina. A rapid digitalisation, vast internet and mobile adoption have opened many former offline shopping enthusiasts opportunities — e-wallets, virtual or prepaid cards and much more. A good variety of options is something that will motivate many to try e-commerce for the first time. At the same time, Argentina faces many obstacles that the country must overcome: fraud, logistics, distrust. On top of that, for the new players to join the market, the regulations, such as “PAIS” tax and others, must be eased to increase the population’s purchasing power parity. Argentina has all the chances to become the e-commerce leader, and it’s important not to miss this opportunity.

Follow us on Facebook, Twitter and LinkedIn to get more insights on what we do.