Overview of E-commerce Market in Singapore in 2020

Singapore's economy is a powerhouse of the Southeast Asian region and one of the world's leading economies. With its GDP expected to reach $340 billion by the end of 2020, according to Trading Economics (2020), the country with a population of just over 5.6 million is also rapidly developing in terms of acceptance of the digital economy and e-commerce possibilities.

E-commerce overview in Singapore 2020

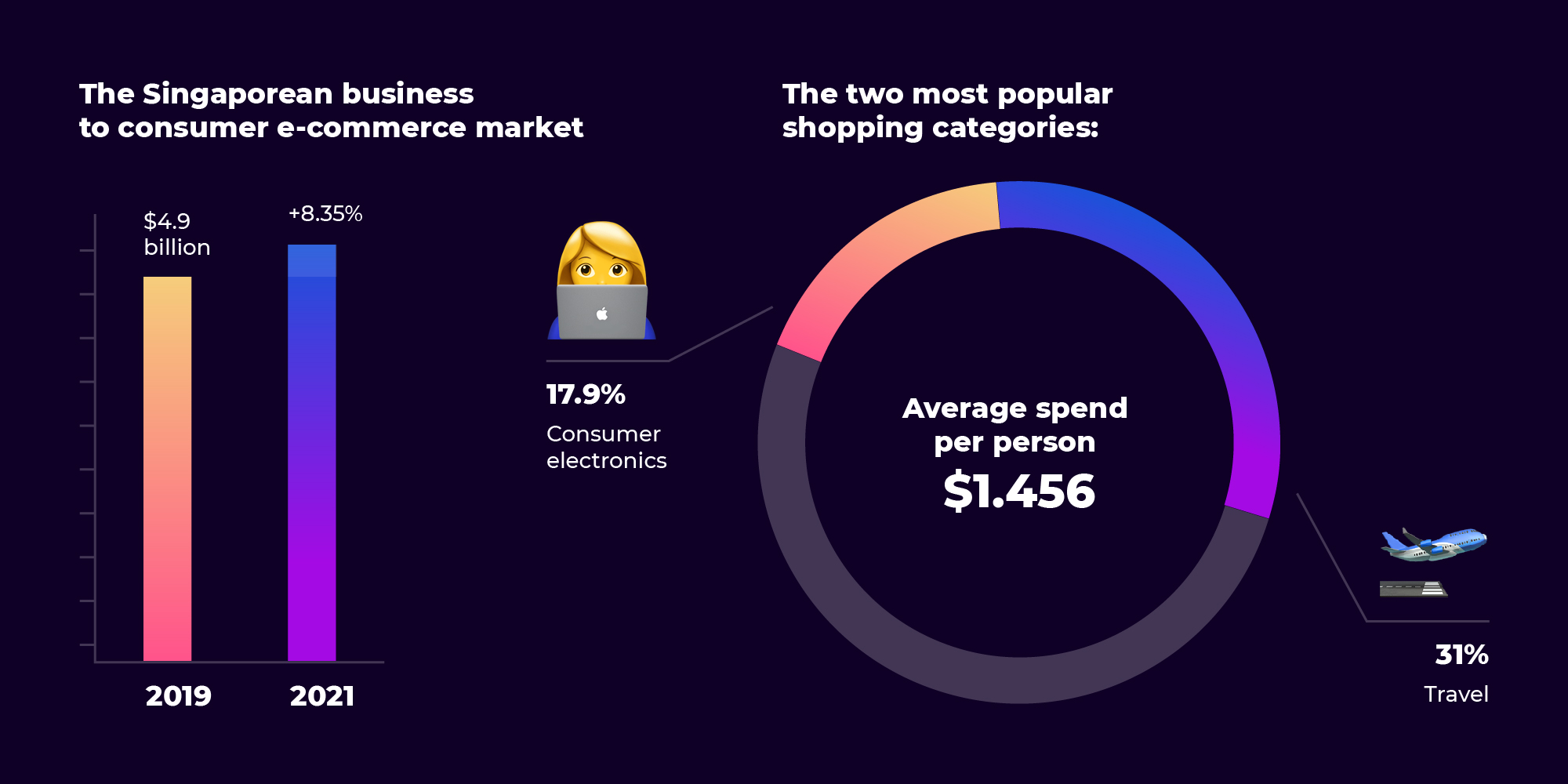

A recent report by JPMorgan (2019) stated that the Singaporean business to consumer e-commerce market was worth $4.9 billion in 2019 and is expected to grow at a compound annual growth rate of 8.35% in 2021. The average online spend per annum is $1,456, with shoppers open to making big-ticket purchases online. Consumer electronics stand at 17.9% and travel at 31% as the two most popular shopping categories.

The country’s excellent internet technology will support the growth of Singapore’s e-commerce market, where fixed internet connections typically almost triple the global average speed. The country also enjoys a highly reliable, secure information and communications technology infrastructure. These factors have promoted high internet and mobile penetration levels among citizens.

Despite the country’s affluence, e-commerce in Singapore as a percentage of overall retail spending is low compared with European countries such as the UK and Germany and stands at just 4.2%. The growth of the online shopping market in Singapore will also be fuelled by a young, tech-savvy population, as 80% of Singaporeans are aged under 54, and the country has a growing middle class. Consumers have a high disposable income.

State of mobile commerce

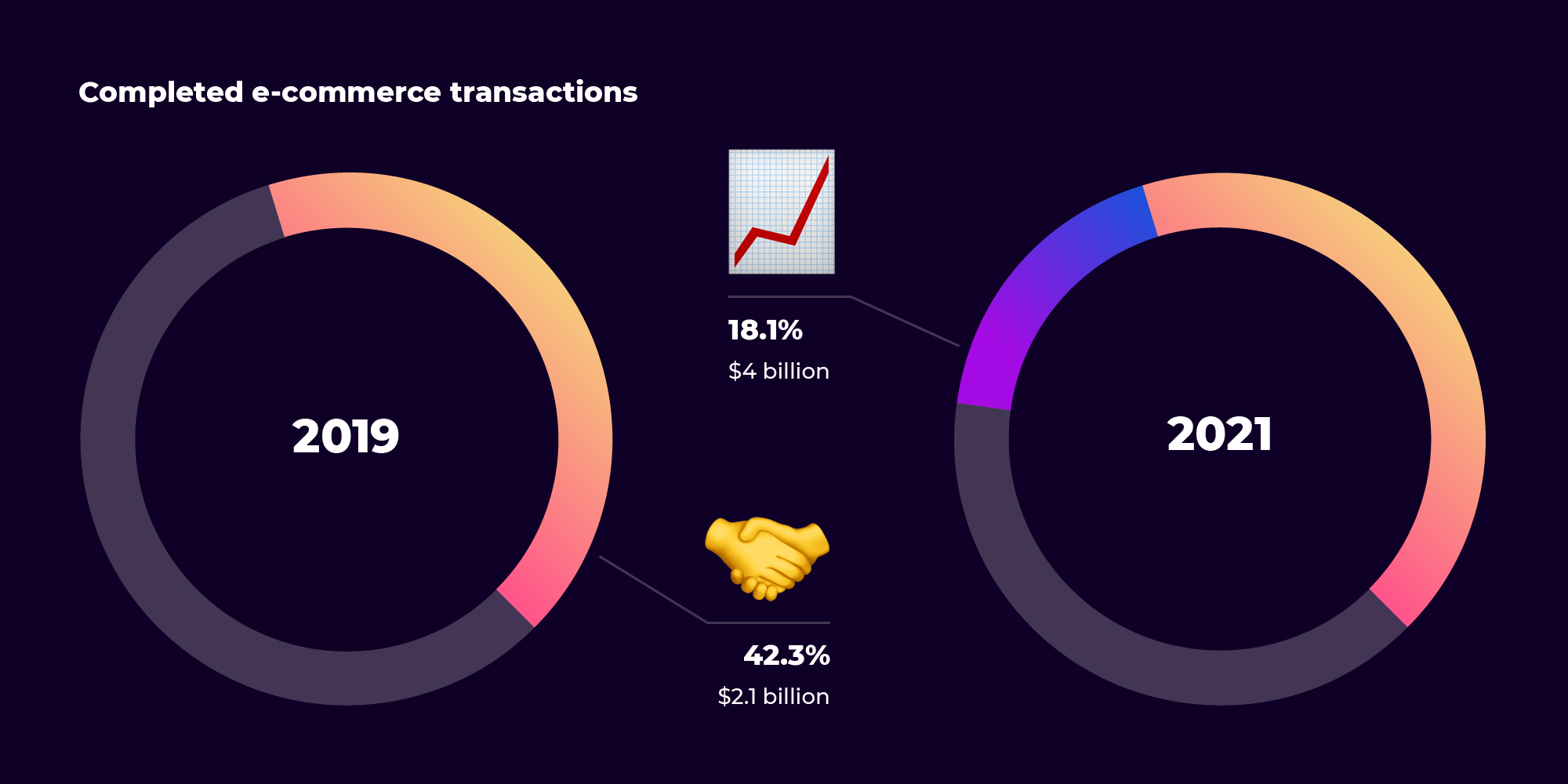

The report by JPMorgan (2019) also revealed that Singapore is the world’s second-best country for mobile connectivity. With a score of 86.6 in the Global Connectivity Index 2020, Singapore only trails behind top-ranking Australia, which scored 88.4. Mobile commerce is well-established in Singapore and is creeping towards accounting for half of all online sales. In 2019, it already made up 42.3% of all completed e-commerce transactions or $2.1 billion in sales. Mobile commerce sales are expected to outpace overall e-commerce growth, expanding at a compound annual growth rate of 18.1% to 2021, to reach a value of $4 billion.

Most popular online payments

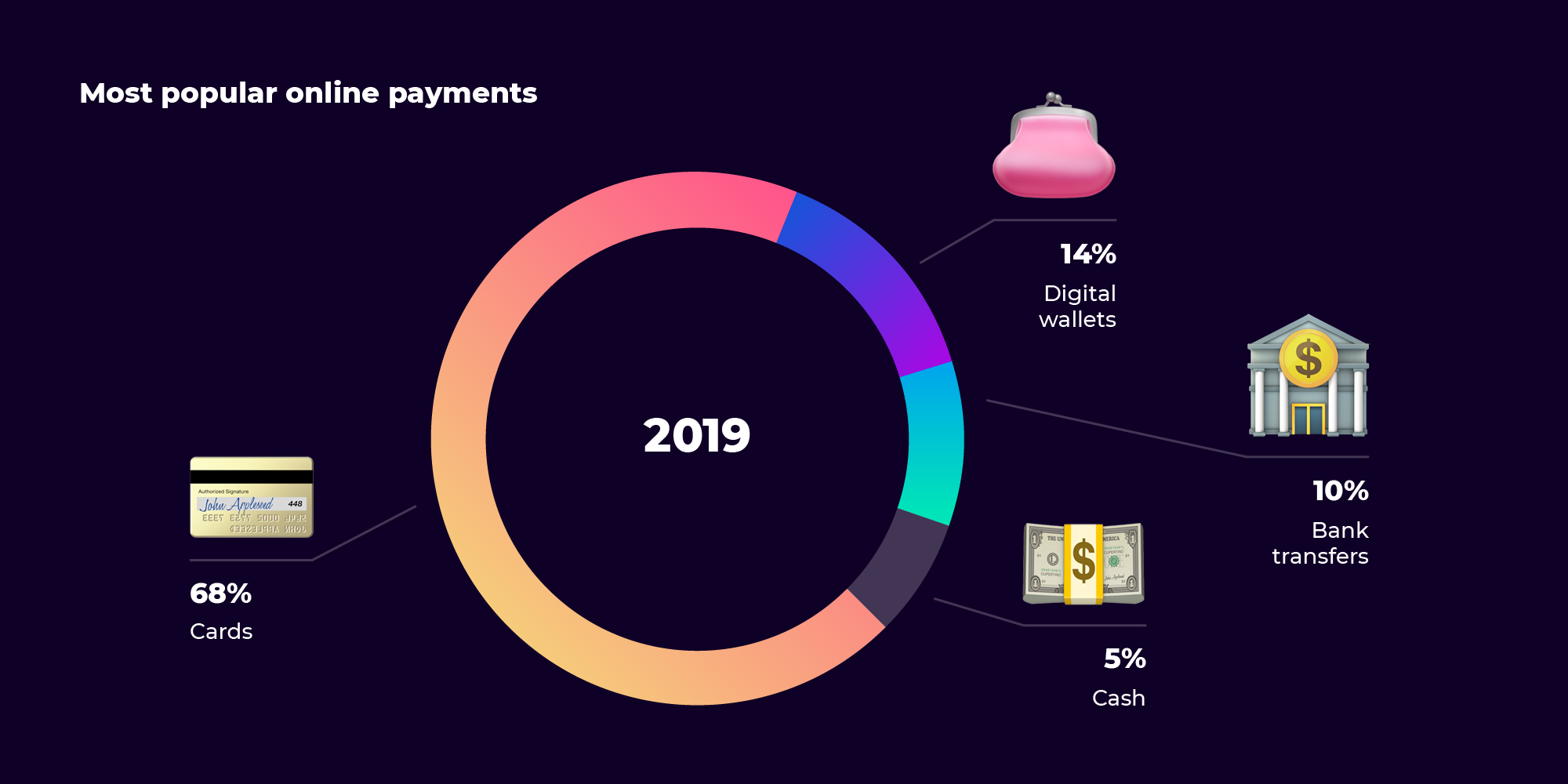

JPMorgan (2019) also revealed that cards are far and away from the most-used method for e-commerce payments, accounting for 68% of all transactions and $3.3 billion of sales. When shopping online, credit cards trump debit cards in use, and Visa is the most popular card brand. Card market share is expected to decline slightly to 2021 when cards are predicted to take a 60.8% share of the market.

Digital wallets are already the second-most popular payment method in Singapore, accounting for 14% of all e-commerce transactions and representing $680 million in sales. Digital wallets are predicted to increase rapidly in use over the next two years, to make up 22.5% of all sales by 2021. Major international brands like PayPal and Apple Pay are well known and used by Singaporean online shoppers, alongside local provider eNETS, an internet-based online payment method that allows shoppers to make real-time payments via their bank account.

Bank transfers are used for 10% of e-commerce transactions, which is expected to rise slightly to 13.8% by 2021. Cash on delivery is not particularly popular, used in just 5% of transactions, a figure projected to decline to 2% by 2021.

Contactless payments in Singapore

Visa (2020) reports that the contactless card payments trend is the highest among Generation Y respondents at 92%. Singaporeans prefer contactless payment modes when paying for their rides on public transportation or shopping at supermarkets. The top reasons cited for this preference include convenience and rewards.

Visa also recently implemented an option for merchants not to capture signatures as a cardholder verification method to reduce consumers’ physical contact with the point-of-sale machines and enable a more frictionless payment experience. This is in addition to increasing contactless payment transaction limits, from the previous amount of $100 to $200, so that consumers can tap and wave their cards or payment devices without signature verification.

E-commerce regulations

A review released by Technology Watch Dispatch indicates that the government’s efforts to ramp up e-commerce spend include plans to make its e-commerce laws and regulations as up to date and globally competitive as possible. For example, the Singapore government has strengthened the statutes and regulations around intellectual property rights for e-commerce to increase consumer confidence in online shopping.

On 12 June 2020, Enterprise Singapore and the Singapore Standards Council launched Technical Reference 76: the first-ever guidelines to set out a national standard for e-commerce transactions. The standard is aimed at boosting the digitalization of SMEs and the burgeoning e-commerce sector in Singapore.

Conclusion

The reports indicate that Singapore's e-commerce market is projected to grow despite all of the economic tribulations the global economy is facing. It is becoming evident that the challenges presented by 2020 have only spurred the growth of the market and are likely to act as drivers soon not only for Singapore but also for many countries in the region whose economies are interwoven with that of Singapore.

Follow us on Facebook, Twitter and LinkedIn to get more insights on what we do.